Get your MMCo Score and Church Audit Report

Align stakeholders and set a clear path for your congregation and property.

Take the first step towards transforming your property

Assess your church’s potential to convert its property into a community asset based on three key factors.

Financial Readiness

This score and its findings are designed to assess your church’s financial stability.

- Runway length

- Expense management

- Income diversification

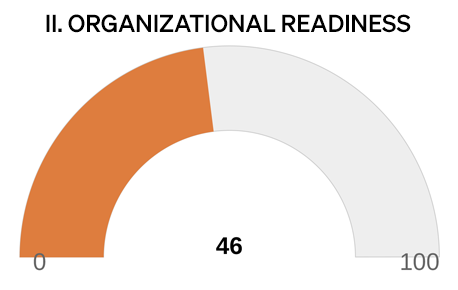

Organizational Readiness

This score and its findings will help grasp the “people” aspect of the changes your church is facing.

- Mission clarity

- Organizational capacity

- Decision speed

- Partner mindset

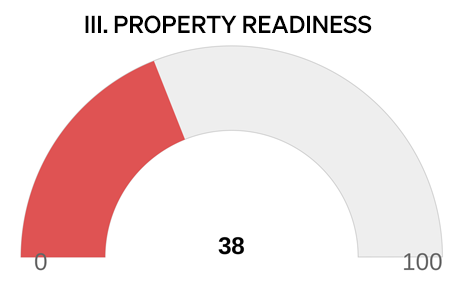

Property Readiness

This score and its findings offer a comprehensive assessment of your property’s value to Mission Adjacent Partners. It’s the first step in starting a conversation about maximizing this value to fulfill your church’s mission.

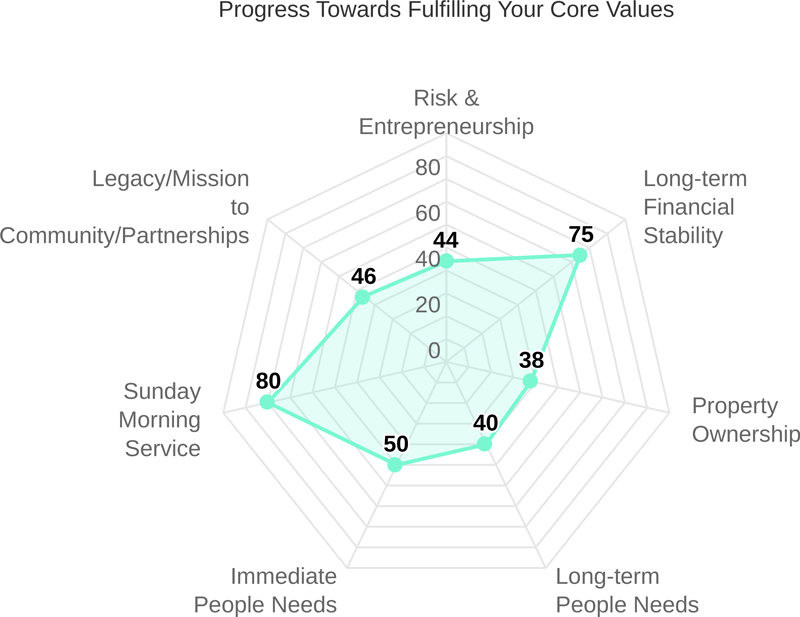

Ranked Church Values

This is designed to address the question, “How might we allocate resources, including property usage, to better align with our values?”

Core Values:

- Long-Term Financial Sustainability

- Legacy/Mission to Community/Partnerships

- Long-term People Needs

- Sunday Morning Service

- Immediate People Needs

- Property Ownership

- Risk & Entrepreneurship

Perceived Neighborhood Needs

This is designed to address the question,”How does our Perceived Neighborhood Need priority align with real-world data on Neighborhood Profile (Who?) and Needs (What?)?”

Perceived Neighborhood Needs:

- Family

- Marriage

- Food Security

- Housing

- Childcare

- Employment/Business Ownership

- Transportation

- Healthcare

- Technology

Household Data (Hawaii only)

This is designed to answer the questions, “Who is our neighbor?” and “What are their needs”? It utilizes census data and a synthetic data model of households within a 1.5 mile radius of the church property. Metrics include: number of households, median household income, home ownership percentage, SNAP recipient percentage, percentage with children under 5 years old, ALICE percentage, Poverty percentage. This information informs churches about neighborhood needs and aligns with their Mission.

How it works

One person fills out the financial and property sections of an online scored survey, while church leadership team members complete the Transformation Readiness section. MMCo scores and analyzes responses, generating an Overall Score and individual scores for Financial Health, Transformation Readiness, and Property Potential. Individual factors are also scored. Although Church Values and Perceived Neighborhood Needs are not scored, they facilitate discussions on Mission among the leadership team.Church Leadership, Judicatories, Denominations, Church Consultants, Lenders, and Developers rely on the MMCo Score and Church Audit as a common language for property development viability. These tools help pinpoint where to engage with church leadership in transforming their property into a community asset.

Hawaii-based churches receive household data within a 1.5-mile radius of their property, including metrics like # of households, median income, % home ownership, % SNAP recipient, % with children under 5, % ALICE, and % Poverty. This information guides churches in understanding neighborhood needs and aligning with their mission.

Testimonials

Community Church of Honolulu hired Mission Management to help us take a close look at our resources: physical, spiritual, numerical and otherwise. The MM team was able to quickly identify and distill the critical issues our community faced, communicate them with clarity and conciseness, and guide us as we discerned a way forward. We celebrate our work with Mission Management because that work has become the foundation of new energy and life in our beloved community.

Pastor Amy Butler

Community Church of Honolulu

Josh Hayashi provided invaluable information and guidance to our church, Waipahu United Church of Christ, in helping to consider the options we felt were needed to financially secure our church’s future.

His Mission Management got several developers to submit their proposals which provided our church leadership with various outcomes if we went forward to either sell or lease the church’s property. The entire process of reviewing the various proposals and coming up with a final recommendation on the best proposal for our church took almost 1-1/2 years, with over 25 meetings with the steering committee and in-depth discussions. Several talk story sessions and small discussion groups during and after church service gave congregants an opportunity to learn more about the final recommendation and to ask questions. Josh’s management guided us throughout the entire process until the congregation was given our analysis of the best choice of the three proposals. Although our leadership team unfortunately could not move the congregation to a decision to proceed with the sale, it was not by any means the fault of Mission Management nor was it for lack of information provided. I feel that the diligent efforts by Josh to help us is still of great value and importance to our church and its now new leadership.

Clarence Nishihara

Past Moderator, Waipahu United Church of Christ

The Mission Management Company has been essential in the discussion and movement of my former congregation’s embracing the asset of their church campus for the mutual benefit of the community and the church. Their work and wisdom gave energy and practical ways to open up our building that has given new life into that congregation.

Rev. Dr. Rich Jones

Westwood First Presbyterian Church

Case Studies

Wailuku Union Church (WUC)

Background Wailuku Union church was opened in 1866. The entire property is zoned historic and is located in the county seat. The church wanted to connect its mission to the real needs of the community and also needed a revenue stream for its declining population. The church had attempted to develop housing on the property for several years but contacted MMCo’s Joshua Hayashi in 2019. The fires in nearby Lahaina made housing more important. Read full case study >

MMCo Score and Church Audit Revealed:

MMCo Score: 55. This score indicates that Wailuku Union had several elements areas already in place to implement alternative, mission-based uses for their property. They had strong relationships with the community and understood the importance of their legacy in the larger Wailuku Community.

Like many churches today however they were considered “property rich and cash poor”. They were in a financial tenuous situation with decreased tithing and virtually no savings for increasing fixed costs.

They have strong Mission Clarity and immediately identified potential partners and the most immediate needs they could help to address in their community. This was exacerbated by the devastating fires on Maui in 2023. Property Potential score of 47 on the lower side due to Historical registered buildings and encumbrances. This allowed the church leadership to focus on zoning with the municipality and by partnering with a non-profit housing developer that was familiar with the county and its specific people and policies.

Ke`anae Congregational Church

Background: The village of Keʻanae is approximately halfway between Wailuku and Hana. Its population is made up of approximately 40 individuals, primarily indigenous native Hawaiians. Its inhabitants trace their lineage and life through the families that have farmed and worked on this land for generations. The land it is famous for its incredible beauty. Each day, hundreds of tourists on their way to Hana, stop into Ke’anae. Keʻanae Congregational Church, built in 1856 is at the center of the Keʻanae village. The building survived a tsunami in 1946 and continues to serve as the hub of village activity and services. The last three remaining attendees of the church and the larger Keʻanae community agreed to meet with MMCo in the Fall of 2021.

MMCo Score and Church Audit Revealed: The score indicated that in order for the church to survive past this year, they needed to reach out for help and support and to do something ultimately entrepreneurial and in faith. Short-term and Long-term financial stability was very low. There was no income other than the on-going tithes and offerings of the three remaining members. And, with only a few members remaining who are well in their “golden years” organizational capacity was low. In addition, the church faced internal conflict that hampered its Mission Clarity. However, there was an openness to entrepreneurial risk and a willingness to look for a mission adjacent partner that could use the property. The overall score while low, identified the potential in somehow capturing the tourist market

Renewal & Revitalization: The MMco score allowed the church to ask for new leadership that fit this criteria and re-integrated Kamaile Pahukoa to the church. Granddaughter to one of the three surviving members, and works in the corporate office of Maui Jim. Kamaile saw this moment as a time to start a business that engages the tourist market and bring in revenue ot the church. Read full case study>

Pearl City Community Church (UCC)

Background:

Pearl City Community Church, was founded in 1929 as a ministry to native Hawaiians and Japanese immigrants. Once at the center of a thriving suburb of Honolulu, the neighborhood has changed. New immigrants and other groups have changed the demographics of the area. Over the years, the church has accumulated several neighboring adjacent properties. The church recognizes the needs in the neighborhood in addition to their decline necessitate a significant change.

MMCo Score and Church Audit Revealed:

MMCo Score: 68. On the outside PCCC looked healthy but their impact on the community was dwarfed by the potential to meet other significant needs. The financial health of the congregation was median due to investments, but their tithing income had stalled. Their high property potential score was due to their location a transit oriented development zone. However their transformation readiness is lower due the fact that they do not have a minister and their leadership is aging.

Renewal & Revitalization: The audit revealed to the leadership the property as a “pearl of great price” available to them. They saw that they needed to adjust their vision of what was possible on the property and who they could reach. The score helped them see that they needed help with change and grief. Their relationship with other non-profits gave them the insight into real community needs. They hired Mission Management to create a process for discernment that prioritizes the mission of the church in the midst of a future development

Fleming Road

Background Fleming Road UCC was founded in 1997, a merger of three different congregations, St. Johns, St. Matthews and Carthage UCC. All three congregations shared a common German heritage and ministry that dates back to the 1800s. Like other mainline churches, Fleming Road is also facing decline but has significant property assets. Their leadership group is highly engaged in their neighborhood and wants to share its space with their neighbors.

MMCo Score and Church Audit Revealed:

MMCo Score: 62. This score indicates that Fleming Road had several elements areas already in place to implement alternative, mission-based uses for their property. They had strong relationships with the community through various non-profits organizations and groups. Their leadership is clear about mission and the role their property could play in alleviating fixed costs against declining tithing.

Their score revealed that their partnerships in the community with various groups was a key to combine both mission to the community and create an income stream utilizing their property.

Renewal and Revitalization

The MMCo score helped to focus their energy towards upgrading their commercial kitchen Several of their leaders became certified to operate and manage the kitchen and they engaged a local non-profit kitchen collaborative to manage usage and schedule. Their score also helped them to engage a denominational lender for upgrades to the kitchen and other parts of their campus. Their energy and work has resulted in a income that was greater than their expenses this past year.